Financial freedom starts HERE

"I'm sick of living paycheck to paycheck.", "I don't need to be super rich but I'm tired of always being broke and I want to fix it", "Where does all my money go? “The system is rigged.”, “It’s impossible to get ahead unless you already have money.", "What’s the point of saving? It’s never enough.",“I work all the time and still can’t afford anything.", "I wish I had bought bitcoin in 2010".

Ever said or thought one of these things? Good. It means you're angry, and angry is a real good motivator for change. When we get enough anger there is a point where it spills over to a new feeling, a feeling where people but up against the most difficult first step of financial freedom: acceptance.

The most difficult step

The acceptance stage is the most important because it means that you've realized that your current way of managing finance is not working. You have to accept that you're not going to be rich and/or famous just because you showed up to life, or that you might have above-average intelligence and you have done well in life but you're still fucking your money up, or that if you extrapolate your current financial situation into the next 30 years you don't like what you see.

These are all humbling and often terrifying things to think. So terrifying that most people won't go anywhere near them. It's easier to bury these ideas deep inside ourselves and pretend we never think about them and pray we can go through life blissfully unaware that this situation is stressful, and heavy, and not improving. It's easier to avoid these thoughts and simply blame the economy, the politics of the day, or our lot in life. It's easy to deflect. It's safer to say its not our fault.

If this doesn't sound exactly familiar it's because deflection is more subtle than this. Its things like "I'll save money when I make more money" or "I work hard therefore I deserve this car or this vacation", these rationalizations are more socially acceptable, but the financial result is the same.

I know these thoughts well because I was a financial wreck for decades. I intimately know the mental gymnastics we put ourselves through to avoid fixing our financial problems. The reason millions of Americans are constantly in financial turmoil is because we will do anything to avoid admitting we are at fault and confronting the problem face first.

To be clear, lots of things are not our fault. Life is unfathomably unfair. You did get an unfair shake, the system is rigged, and getting ahead financially is difficult. You also live in America at a time where you and the richest person on planet earth use the exact same primary tool each day and the quality of life of Americans is outrageously high even compared to 80 years ago.

This is why acceptance is the hardest step, you have to accept responsibility in the face of problems that many you did not create. The reality is that you can change your situation despite these unfairnesses, but blame and deflection are not only easier they are reasonably justified and they make us feel better in the moment They also prevent us from accepting true responsibility and fixing this for ourselves.

Acceptance is not an on/off switch, it's a process, a realization, a maturity, and it can take a bit time but here is the magic of it: Once you accept that you the source of your financial woes you start to become the source of your future financial success.

I can't teach you acceptance just like I can't teach an addict to quit drinking, smoking, or injecting their favorite chemical. Each person has to come to a place of pain so great that accepting they have to sacrifice their current life for a new one becomes the only option.

The second most difficult step

If you can get in shape, you can become wealthy.

Everyone knows how to get in shape. It's not a secret, it's not magic, it's not even complicated.

- Go to the gym 4-5 hours a week

- Eat healthy foods

- Avoid sugar & junk food

- Do this 80% correctly for the rest of your life

If you follow these steps you will be fit, for sure, yet people don't do it. Why?

Because it requires us to sacrifice all the things we want/have to do today: we have a family and responsibilities, we have chores, we want to hang out with friends, we want to go out and do something fun or go shopping, or maybe we just want to relax. Everything is more important and fun than the gym.

The gym also doesn't provide any immediate feedback. If I go to the gym and work my ass off every day it'll still take 3-4 months to see any difference. If I sit at home with my family I get an immediate pleasure response.

This is why the second most difficult step is sacrifice. Financial freedom requires sacrifice. No matter how much money you're making I guarantee you can live on less and invest a portion of it and for most people at that is going to be painful. It was painful for me as well. Both are based on habits and once you get in a good habit you realize that even though the benefits are delayed they are worth so much more than any short term gratification. I have driven a shitty car and worn cheap clothes and skipped a lot of dinners for 15 years now, all of which sucked at first but now I have enough money to travel to Africa for a month and hike Kilimanjaro. I'm still well fed, no one cares about my dumpy car, no one noticed I dress like a bum, but I'll tell you that every single day I'm grateful for my physical and financial health - and you will be too. This is a good trade.

Let's start thinking about what you can sacrifice.

The least difficult step

Creating wealth is simple, it's available to everyone, and there is a near guaranteed way to do it. I encourage you to make it a hobby, just like fitness. You don't have to become a bodybuilder to get a gym membership and you don't need to be a wall street banker to be a millionaire. Just like the gym you need to:

- Spend 4-5 hours a week on it

- Intake good financial content

- Avoid bad spending and consumer debt

- Do this 80% correctly for the rest of your life

If you go to the gym for 100 hours a week every week for the next 6 months you would still not be a professional body builder. You would have made some progress but you'll also be burned out. There is no way you can get so good at fitness in the next 6 months that you become rich, so don't put too much pressure on yourself. This works when you create and sustain good habits.

Once you have gone through acceptance, realized you're going to have to make sacrifices, and understand that this is an effort in proper behaviors - you're sure to ask what are the proper behaviors?

Learn and live by the rules of money

- Pay yourself first, no matter what

- Don't spend money on things that don't make you money

- Get to ZERO consumer debt as fast as possible

(There are more but you need to go learn them!)

Track your finances

Get an account with personal capital and put all your accounts in here. It'll tell you what your net worth, where all your money is going, and it's free. (If you sign up using this code then we both get $20). Do this monthly.

Then start getting in the habit of checking your bank account first thing in the morning every single morning. The reason we do it every morning is because we want our habits to reflect our values, and we value our money health. It'll also get you acutely aware of where every single dollar is going.

What you pay attention to, grows

Tactical

- Open a high interest account (I use Ally bank) and put at least 5% of your gross monthly income in that account as soon as you get paid, then pay rent, then figure out how to survive

- If possible, max out your employer 401k tomorrow

Intake personal finance and investing content

- Read "The Richest Man in Babylon" - This is dirt cheap in paperback and Audible (I love Audible)

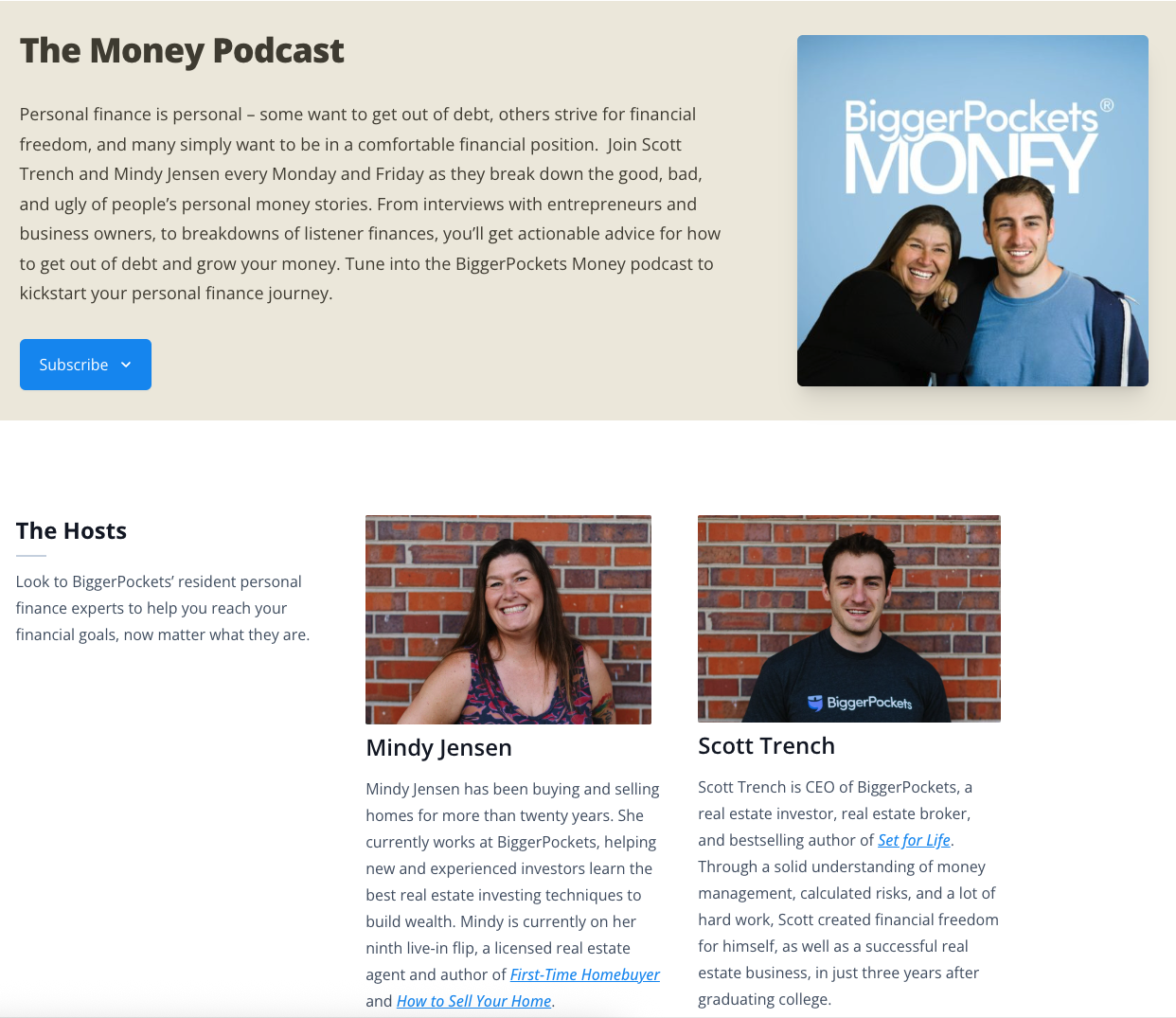

- Listen to the "BiggerPockets Money" podcast, 0r find others, there are hundreds of thousands of personal finance podcasts.

- Curate your Instagram and TikTok and YouTube feeds with more personal finance content, you need to get this stuff in your brain. You need to brainwash yourself that this way of life is normal.

Find people to talk about money with

You can't do this alone and it's not fun to do alone anyway. You need people around who think this way, to remind you it's possible and to keep you accountable.

There are million of people in America who are open to talking about money. Find them on Facebook, on meetup.com, ask your friends, reach out to people you know online talking about money (me!). Remember, this isn't a task this is an ongoing behavior.

You are the average of the 5 people you surround yourself with. If you hang out with broke people you will be the 6th...

Amputate bad habits

Take 90 days where you spend $0 total dollars on unnecessary things. No fast food, no date nights, no video games, no apps, no subscription, no new clothes, no booze, no nothing. Nothing. Nothing. Spend nothing that isn't absolutely essential for basic survival for 90 days. Nothing. Let's see exactly how addicted you are to spending money.

This is also a good time to start having hard conversations with partners and children about what is important what isn't. What you want your future to look like and how you're going to get there. This part is difficult for many people because it's almost never the case that one person is an irresponsible spender and the other isn't, people usually match each other closely. So you might be ready for change but your partner isn't, that's ok, it might just take a little time to beat them down so they see your way ;)

The last difficult part

You need to believe

Everything I told you here is behavioral and basic, it's all step one. Its sacrifice, and learning, and lifestyle changes.

As you believe in and act out these behaviors you will save a little bit of money each and every month and that will earn interest and the account will grow. As you invest more of your time into personal finance and investing confidence and understanding will increase, so will your belief in this process. You need to have friends who are also on this journey, like me and millions of others, who have changed their financial future with simple and effective habits so you barely have to believe because you can see the results with your own eyes.

The more you're around it and the more you see it happening, the more you will believe. As you believe more, you will find ways to accelerate this process, and then this whole thing becomes even easier.

My case study

Here is my real world example:

When I began to learn all of this I was skeptical. I didn't earn much money and I wasn't going to be able to save a lot so I didn't see how this could work? The important thing was that I tried anyway. ~12 years later I am extremely confident that this works, so if you're skeptical, try anyway. The worst thing that can happen is you save a little money.

The first thing I did was open a "high" interest savings account with a bank called Ally (there are many options like this". Every payday the first thing I would do is take 20% of my income and transfer it to that account, this is before I would pay my rent and buy groceries, then I lived on what was left - and it was very painful. A good aspect to this method is that because I saved first I could then spend my account down to $1 each month and not be stressed because the responsible part was done up front. I still live this way and I still run my accounts down to almost nothing each month and my wife thinks it's so stressful but the savings account grows.

The Ally account did not have a debit card so if I wanted to spend that money it took 3 days to transfer it back to my main account which prevented me from impulse spending, which I am very guilty of.

It was very little money at first, but it grew, and then it accrued a little interest, and then it grew. The whole first year I did this was 2012 and I grossed $47,000 and I saved $6,000. This is not enough money to invest or do anything with but the habits started to stick and I had never seen that much money before. I began to make a game of it.

The next year I made a bit more money at worked and I saved $10,000. With interest I then had about $16,500 total in two years. Is this life changing money? Not really but think about what this represents. Are you going to live another 5 years? What about 30? What could you do if you saved $6,000 every year? Let's do some calculations:

$6,000 x 30 @ 0% interest = $180,000

$6,000 x 30 years @ 4% interest = $336,480

$6,000 x 30 years @ 9% interest (the average S&P500 return) = $817,800

What if we could put away $1,000 per month

$1,000 x 30 years @ 9% interest = 1,275,600

and lastly, since this is a forever habit, let's say we are 30 years old and we plan to live to 100 years old (I intend to live to 120 years btw

$6,000 x 70 years @ 9% interest = $37.5 million

THIRTY SEVEN MILLION DOLLARS if you invest $500 per month/$6,00 per year into the S&P for the next 70 years.

but wait, there is more.

Remember how I said part of the behavior is investing in our knowledge and finance community as well? About 4 years into this journey I was turned onto real estate and found I didn't have to earn only 9% on average, I was able to juice that into a current lifetime return of well over 1,000%.

Not only will a small amount of money compound, your knowledge will also compound. This is why the podcasts and the content and being around people how are also on the journey is so important, and you don't have to become obsessed, you just have to take it seriously for a few hours a week. Just like the gym - it's a hobby.

Recap

Start enacting these behaviors, today

- Read "The Richest Man in Babylon"

- Listen to at least one personal finance podcast per week

- Pay yourself first 5%-20% of your income FIRST - NO MATTER WHAT

- Max our your 401k if you have one

- Add no new debt and start paying off debt

- Track your finances 3x per week

- Track your net worth at least once monthly

- Talk to friends who help you stay accountable and keep believing in the process

Good luck